Gold Ore Mining And Processing In Nigeria, The Feasibility Report.

Gold mining is a global business with operations on every continent, except Antarctica, and gold is extracted from mines of widely varying types and scale.

Mines and gold mining operations have become increasingly geographically diverse, far removed from the concentrated supply of four decades or so ago when the vast majority of the world’s gold came from South Africa.

China was the largest gold producer in the world in 2016, accounting for around fourteen percent (14%) of total annual production. But no one region dominates. Asia as a whole produces twenty-three percent (23%) of all newly-mined gold. Central and South America produce around seventeen percent (17%) of the total, with North America supplying around sixteen percent (16%). Around nineteen percent (19%) of production comes from Africa and fourteen percent (14%) from the Commonwealth of Independent States (CIS) region.

Overall levels of mine production have grown significantly over the last decade, although substantial new discoveries are increasingly rare and production levels are increasingly constrained.

The Ministry of Mines and Steel Development (MMSD) had identified thirty-four (34) minerals of economic importance in Nigeria across the six regional mining zones.

Every state, apart from Bayelsa is said to contain areas of mineral wealth. Within the minerals, Government has highlighted a number of strategic minerals that have the potential to contribute significantly to Nigeria’s economic development. These include barite, gold, bitumen, iron ore, lead/zinc, coal and limestone.

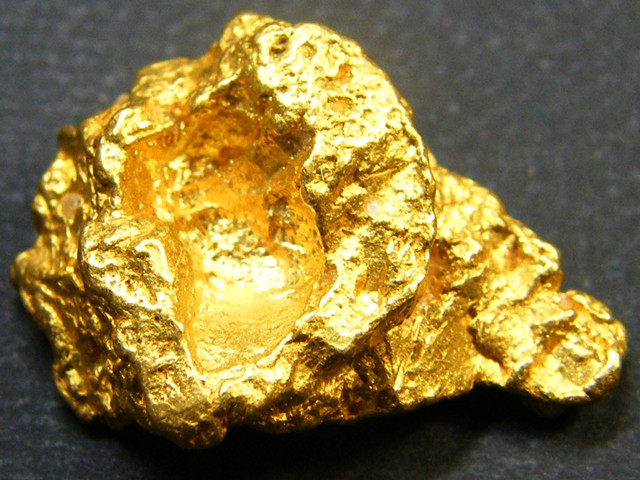

Gold is a chemical element with symbol Au (from Latin: aurum) and atomic number seventy-nine (79). Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow colour and luster traditionally considered attractive, which it maintains without oxidizing in air or water.

There are proven reserves of both alluvial and primary deposits of gold with proven reserves in the schist belt covering the western half of Nigeria.

The most important occurrences are found in the Maru, Anka, Malele, Tsohon Birnin Gwari Kwaga, Gurmana, Bin Yauri, Okolom Dogondaji and Iperindo areas, all associated with the schist belts of north-west and south-west Nigeria. There are also a number of smaller occurrences beyond these major areas.

At present exploitation of alluvial deposits is being carried out mostly by artisan miners in a few places in the country. A number of primary deposits, which are sufficiently big for large scale mining, have been identified in the northwest and southwest parts of the country.

Given the huge quantity of gold stored above-ground compared to the annual production, the price of gold is mainly affected by changes in sentiment (demand), rather than changes in annual production (supply).

Gold has emotional, cultural and financial value and different people across the globe buy gold for different reasons, often influenced by a range of national socio-cultural factors, local market conditions and wider macro-economic drivers.

Gold’s diverse uses, in jewellery, technology and by central banks and investors, mean different sectors of the gold market rise to prominence at different points in the global economic cycle. This diversity of demand and self-balancing nature of the gold market underpin gold’s robust qualities as an investment asset.

Global demand for gold in 2019 will rise to the highest in four (4) years as higher consumption by jewellers offsets a fall in purchases by central banks.

The world will consume four thousand, three hundred and seventy (4,370) tonnes of gold this year, the most since 2015 and up slightly from four thousand, three hundred and sixty-four (4,364) tonnes in 2018.

This report seeks to examine the financial viability or otherwise of mining gold ore and processing same in Nigeria.

The business would entail using mechanized method of mining to produce two hundred (200) tons of gold rocks per month with a minimum of twenty (20) grams of gold concentrate per ton and recovery rate of ninety-five percent (95%). The plant would produce gold concentrate of eighteen karat (18 K) purity.

Custom Research Request

Still haven't found what you're looking for?

Speak to our Custom Research Team.

Table of Contents

EXECUTIVE SUMMARY 1. Business Overview 1.1 Description of the Business 1.2 Incentives / Government Policy 1.3 How to Obtain a Mining Lease in Nigeria 1.4 Occurrence and Distribution of the mineral in Nigeria 1.4 Critical Success Factor of the Business 1.5 Description of the Business Industry 1.6 Contribution to Local and National Economy 2. Marketing Plan 2.1 Description of product 2.2 Location 2.3 The Opportunity 2.4 Pricing Strategy 2.5 Target Market 2.6 Distribution and Delivery Strategy 2.7 Promotional Strategy 2.8 Competition 3. Technical Analysis 3.1 Description of the Location 3.2 Raw Materials 3.3 Production Technology / Equipment 3.4 Production Process 3.5 Production Cost 3.6 Stock Control Process 3.7 Pre-Operating activities and expenses 3.7.1 Operating Activities and Expenses 3.8 Project Implentation Schedule 4.0 Organizational and Management Plan 4.1 Ownership of the business 4.2 Profile of the promoters 4.3 Key Management Staff 4.3.1 Strategic Business Units 4.3.2 Management Support Units 4.4 Details of salary schedule 5. Financial Plan 5.1 Financial Assumption 5.2 Start up Capital Estimation 5.3 Source of Capital 5.4 Security of Loan 5.5 Loan Repayment Plan 5.6 Profit and Loss Analysis 5.7 Cashflow Analysis 5.8 Viability Analysis 6.0 Business Risk and Mitigation Factor 6.1 Business Risks 6.2 SWOT Analysis

Project Specification:

Additional Info

Get this Report

Direct bank transfer

To order the report, Please do pay the sum of ₦100,000 into

Account Name : Foraminifera Market Research Ltd

Account Number : 274 20 569 37

Account Name : Foraminifera Market Research Ltd

Account Number : 101 76 603 95

Account Name : Foraminifera Ventures

Account Number : 011 66 066 32

Make your payment directly into our bank account. Please use your Order ID as the payment reference. Your order will not be shipped until the funds have cleared in our account.

Instructions

After payment call us on 01 -29 52 413 / 08033782777 or email us at foraminiferamarketresearch@yahoo.com with the payment details. After payment confirmation, the soft copy of the report would be sent to you within 24 hours.